Blog

Apr 25, 2023

Surveying the WANscape

This week, Season 4 of TeleGeography Explains the Internet ends on a high note with...

By Greg Bryan

Predicting the future is hard, especially when it comes to complex markets with disruptive variables that are difficult/impossible to model. In his excellent book Thinking Fast and Slow, Nobel winner Daniel Kahneman provides stark examples of how bad humans can be at doing just that.

In this excerpt, Kahneman details how he tracked the performance records of 25 professional wealth managers across eight years. He found that “[t]he results resembled what you would expect from a dice-rolling contest, not a game of skill.”

So, when folks ask me–as they increasingly do–”in light of SD-WAN, what does the future of MPLS look like?” I hesitate to take too definite a position, especially with strong opinions on either side.

That said, I think it’s helpful to look at what we do know and map the possible way those “curves” might move in the next five years.

This post is going to dive mostly into data we’ve collected as part of our recently refreshed WAN Manager Survey, as well as insights gained in last year’s survey effort and our WAN Summit series live polls.

From the start, SD-WAN vendors have touted that SD-WAN—with adequately diverse underlay connections—can functionally replace MPLS. Indeed, we’ve had more than one case study at our WAN Summits highlighting enterprises who have mostly, or even entirely, left MPLS behind. There are also those who have added SD-WAN as an enhancement to their MPLS solution.

And there's no doubt that an internet-based WAN can be much cheaper than an MPLS-based WAN. So where are most corporate networks today?

To answer that, we can look to the network configuration data we collected in the WAN Manager Survey in both 2018 and 2019.

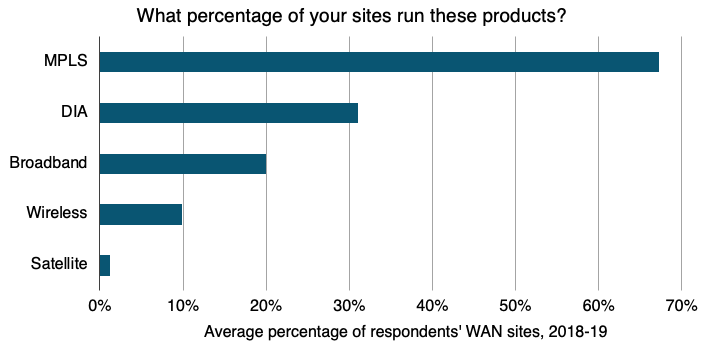

We have network data from 93 different companies in 19 industries. These companies range in size from a dozen sites to 11,000. Most of these networks still rely primarily on MPLS, with an average of 67% of sites running MPLS.

This is a case where it helps to look not only at the average, but the full range of responses:

This varies considerably by industry, too. When we broke out these trends by vertical, we saw that industrial companies had the least MPLS while healthcare companies continued to rely on it the most.

In our 2018 survey we asked enterprise WAN managers about their stage of adoption of SD-WAN. (We're also asking in the 2020 version we are running presently—which you should take if you are WAN manager!)

We found then that 83% of enterprises were at least considering SD-WAN, with 43% already adopted or in the roll-out phase. Those numbers have only gone up.

Notes: Each bar demonstrates the percentage of all 60 respondents who were in each stage of SD-WAN adoption in 2018.

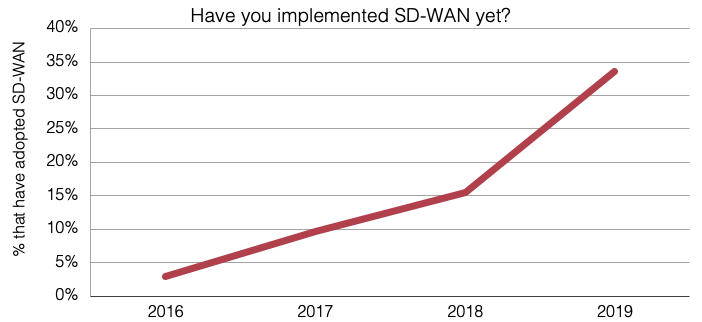

Notes: Each bar demonstrates the percentage of all 60 respondents who were in each stage of SD-WAN adoption in 2018.We also asked about SD-WAN adoption through live polls at the WAN Summit for the past several years. The number of end-user attendees that have adopted SD-WAN has steadily risen.

This chart shows the average percentage of Summit delegates who responded “already installed SD-WAN on at least part of the network.” The four-year CAGR on these live polls is 83%. This means that each year the percentage of end-user delegates that have adopted SD-WAN is multiplied by 1.83.

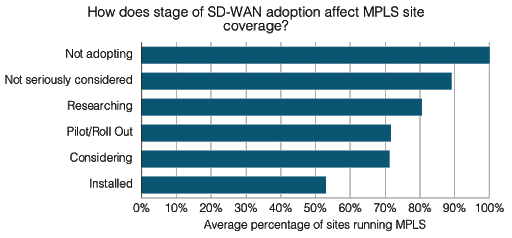

Our data demonstrates that those who already had SD-WAN installed were less likely to have a lot of MPLS left in the network.

Of those companies in our 2018 WAN Manager Survey that had already installed SD-WAN:

We know that SD-WAN adoption has increased, and we know that those who had SD-WAN installed have fewer sites running MPLS.

In 2018, we also directly asked respondents who were planning to adopt SD-WAN what their MPLS plans were. There, we still see some MPLS staying power:

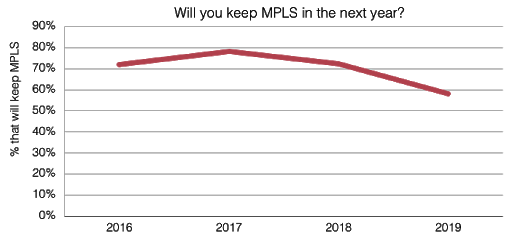

Again, we asked WAN Summit end-users similar questions over the years in our live polls and have seen these numbers shift.

Although there isn’t a smooth curve due to differences in responses at different events, the percentage of folks planning to keep MPLS at all or most sites in the next year has gone down from an average of 72% in 2016 to 58% across events in 2019.

Let’s review what we do know about MPLS usage right now:

How do we extrapolate predictions? First, let’s look at what lends uncertainty:

Now you’re saying, “Come on! Getting a straight answer from an analyst is like nailing jello to the wall.”

Well, ok. Here's what I think is the realistic range of possibilities (without doing the harder math, which we're working on for a new WAN market sizing tool).

Greg is Senior Manager, Enterprise Research at TeleGeography. He's spent the last decade and a half at TeleGeography developing many of our pricing products and reports about enterprise networks. He is a frequent speaker at conferences about corporate wide area networks and enterprise telecom services. He also hosts our podcast, TeleGeography Explains the Internet.

Apr 25, 2023

This week, Season 4 of TeleGeography Explains the Internet ends on a high note with...

By Greg Bryan

Aug 28, 2019

Welcome back to our blog series on “wargaming” WAN configurations to see how product...

By Greg Bryan

Feb 29, 2024

Welcome back to our five-part podcast special that seeks to demystify the internet. Our ...

By Greg Bryan

All Rights Reserved 2026